Venmo has become one of the most popular peer-to-peer payment apps, allowing you to send and receive money between friends and family easily.

While you don’t need funds in your Venmo balance to send payments to others, adding money to your Venmo balance provides additional features and convenience that can come in very handy.

If you have a physical Venmo debit card, you have the option to add money directly from a bank account or debit card to your Venmo balance.

This provides an easy way to load up your Venmo account with funds instantly or within a few days.

Here’s a detailed step-by-step guide walking through exactly how to add money to your Venmo balance through the mobile app.

Table of Contents

Who Can Add Money to Their Venmo Balance?

The ability to add funds to your Venmo balance is only available to Venmo users who have been approved for and activated a physical Venmo debit card. So before you can add money, you first need to go through a few steps to get set up with a Venmo debit card connected to your account.

To get started, you need to open the latest version of the Venmo app on your mobile device and apply for a Venmo debit card directly within the app. This can be done by tapping your profile icon in the top right of the app and then choosing the “Get Venmo Card” option that appears.

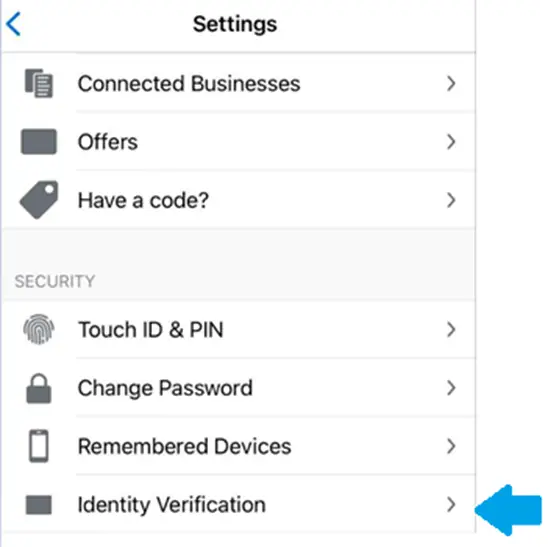

This will prompt you to provide some basic personal information and submit a request for the physical debit card to be mailed to you. Venmo will verify your identity and determine if you are eligible for a debit card based on your account history and profile details.

Once approved, you will receive the actual Venmo debit card in the mail within 7-10 business days. You need to activate it when it arrives by following the included instructions.

Finally, you must connect your now active Venmo debit card to your Venmo app by entering the card details and security code. This links the card to your account.

Once you have an active and connected Venmo debit card, you will now see the option to “Add Money” to your Venmo balance when managing your account in the app. So getting a debit card is the first requirement before you can add funds.

Two Easy Ways to Add Money

There are two convenient ways to add money to your Venmo balance if you have a Venmo debit card:

Transfer Funds from Your Bank Account

The first way to add money to Venmo is by initiating a standard bank account transfer. Within the Venmo app, you can link an eligible bank account and then transfer funds from your bank account directly into your Venmo balance. These bank transfers take 3-5 business days to fully process and settle into your Venmo account.

They take a few days to complete as they move through the ACH network between your bank and Venmo. The money is not usable or available in your Venmo balance until the transfer is completed. You need to ensure you have sufficient funds in your bank account when initiating the transfer. Transfers cannot be canceled once initiated but you can transfer funds back out when settled. Though bank transfers take a bit longer, there are no fees to add money this way. It’s a simple connection between your accounts.

Instant Transfer from Your Debit Card

The second way to add money to your Venmo balance is by instantly transferring funds from a debit card connected to your Venmo account. When initiating a debit card transfer, the funds are immediately available in your Venmo balance for use within the app. It’s the fastest way to load money into Venmo.

The money appears in Venmo almost instantly after the transfer. Your debit card needs to have the available funds to cover the transfer amount. You will be notified if the transfer fails for any reason. There are weekly limits on how much you can transfer from a debit card. So when you need funds added to Venmo right away, a debit card transfer is the way to go.

Steps to Add Money to the Venmo Balance

Adding money directly to your Venmo balance only takes a few simple taps in the Venmo app. Just follow these steps:

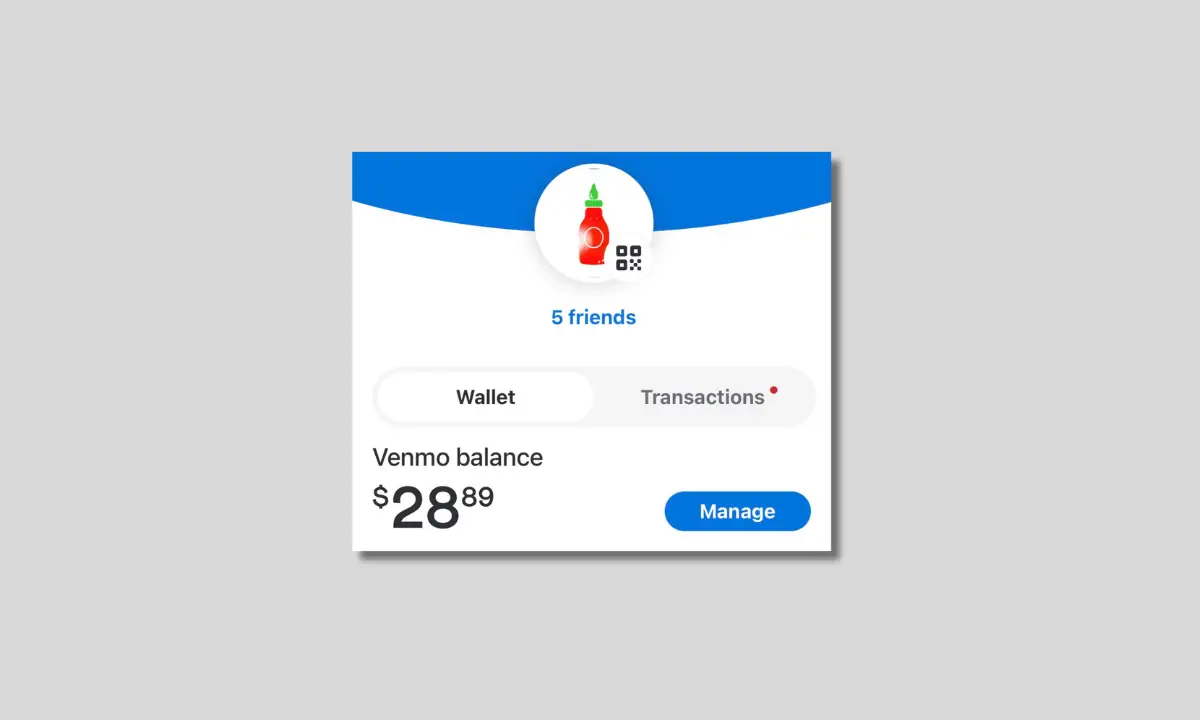

1. First, open your Venmo app and tap the profile icon in the top right corner of the main screen. This will bring you to your profile page within the app.

2. Next, on your main profile screen, scroll down and tap the “Manage Balance” option under the Wallet section. Tapping this will navigate you to the Manage Balance page.

3. On the Manage Balance page, tap the “Add Money” button at the top of the screen to initiate a new money transfer.

4. You will then need to enter the amount of funds you want to add to your balance. Choose any amount up to your maximum weekly or monthly transfer limit.

5. The next step is selecting whether to add funds from a linked bank account or debit card. Make your choice by tapping on either “Bank” or “Debit Card”.

6. After you select the funding source, tap on the specific bank account or debit card you want to transfer funds from. This account needs to already be connected to your Venmo account.

7. Review all the details of the transfer to ensure the amount and account are correct. Read the transfer disclaimer.

8. Finally, tap “Add” to confirm and complete the money transfer. This will initiate the process of adding funds to your Venmo balance.

The funds will then be added to your Venmo balance automatically once the transfer is fully complete. The timing depends on whether you choose a bank transfer or debit card method.

When Can I Use the Funds in My Venmo Balance?

The availability timeline for transferred money to show up and be usable in your Venmo balance depends on whether you chose a bank transfer or debit card:

For debit card transfers, the money should be available for use in Venmo instantly as soon as you initiate the transfer. This allows immediate access to the funds to make purchases or Venmo payments.

For bank account transfers, it takes 3-5 business days for the full transfer process between the bank and Venmo to complete. The money will not be accessible or usable in Venmo until that bank-to-Venmo transfer finishes processing.

Some reasons for potential delays in bank transfer availability include weekends and bank holidays that slow transfers; pending holds by your bank before releasing funds; verification processes Venmo does; and issues with the bank transfer itself.

So debit card transfers provide instant use of funds added, while bank transfers require a bit of patience for the funds to fully settle into your Venmo balance.

Also read: 4 Methods to Venmo Transfer Money to Yourself

How to Keep Track of Your Venmo Balance Transfer Status

Wondering when that money you added to Venmo will really be available?

You can check the status of any Venmo balance transfer right in the app:

1. First, tap on your profile icon on the Venmo home screen to go to your profile. Once there, scroll down to view your full transaction history feed within the app.

2. Find the “Add Money” transfer you are tracking in your transaction feed. The status shown on the transfer will be: Processing (still going through), Completed (finished and available), or Failed (did not go through).

3. If the transfer is still processing after 5 business days, contact Venmo customer support for help.

This allows you to monitor a transfer and see when the funds have fully settled into your available Venmo balance.

What to Do if Your Venmo Balance Transfer Fails

Sometimes Venmo balance transfer attempts may fail or get rejected for a variety of reasons:

The account information entered may be incorrect or invalid. Double-check that you entered the right bank account and routing numbers linked to your Venmo.

Your funding account may have insufficient funds available to cover the transfer amount you initiated. Add funds and try the transfer again.

Also, Your bank account could be temporarily frozen or blocked, preventing Venmo access and transfers. Your specific bank could be experiencing technical issues or Venmo transfer problems on their end.

It could be also possible, that you may have hit Venmo’s weekly or monthly limits for balance transfers from your accounts.

If a transfer fails or gets rejected, you will receive a notification from Venmo by email or in-app message. It will prompt you to try adding the funds again. Reach out to Venmo customer support if you experience persistent errors.

Other Ways to Get Money into Your Venmo Account

Aside from direct bank account and debit card transfers, there are a couple of other ways to get funds into your Venmo balance including:

Instant Transfer – If you already have a Venmo balance, you can instantly transfer funds to your bank account for a small fee.

Direct Deposit – Set up direct deposit with your employer to have your paycheck automatically deposited into your Venmo balance.

Cash a Check – Scan and deposit printed checks payable to you directly into your Venmo account balance.

However, the quickest option to add money to Venmo from external accounts is using a connected bank account or debit card. These options are accessible right within the Venmo app.

Bottom line

Adding money to your Venmo balance is straightforward if you have an activated Venmo debit card connected to your account. Just tap “Add Money” in the app and choose your linked bank account or debit card to transfer funds from.

In just a few quick taps, you can load up your Venmo balance, earn interest on funds, cover payments, and take advantage of instant spending from your Venmo account.

Monitor your ongoing or pending transfers in your activity feed to ensure the money gets added to your available balance on schedule. Reach out to Venmo support if you have any issues getting funds into your account.

Thanks for reading!