Venmo has exploded in popularity as a quick, easy way to exchange money between friends or pay someone back.

But as with any platform dealing with money, scammers flock to Venmo attempting to take advantage of users.

It’s crucial to understand the most prevalent scams circulating on Venmo currently and how to steer clear of them.

Protecting yourself starts with awareness and smart practices.

Here are common Venmo Scams you must be aware of:

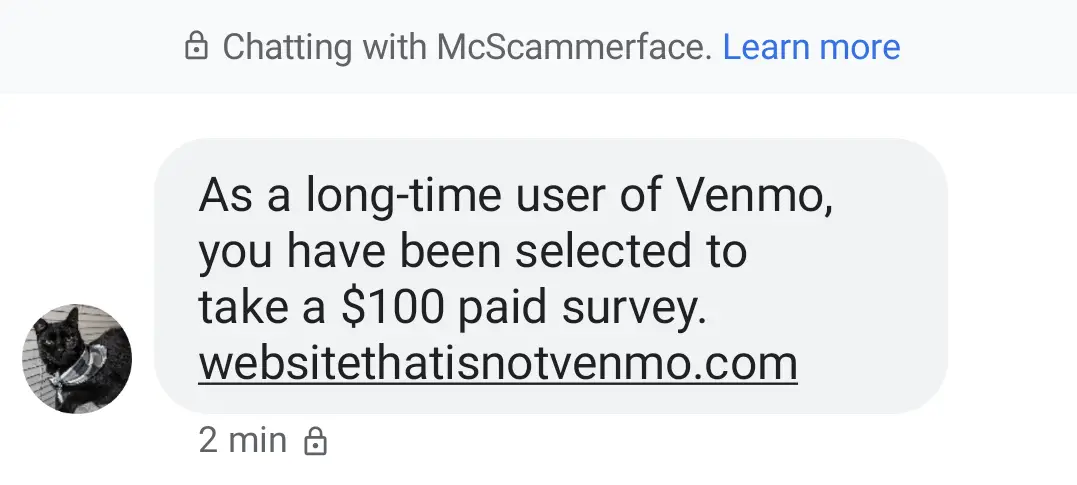

1. Fake Prize or Reward Scams

One very common ruse to be wary of is getting some kind of message that you’ve won a cash prize or reward through Venmo. Often these will come by text, email, or even social media. The message will typically contain some kind of link encouraging you to click on it to claim your prize. Usually, they tell you that you need to log into your Venmo account or provide personal information to receive the money.

However, Venmo will never contact you out of the blue stating you’ve won free money. There are no prizes or rewards to be claimed. This is always, always a scam intended to gain access to your account and personal information.

If you receive a message like this, do not click on any links within it under any circumstances. Links can send you to dangerous fraudulent sites or downloads. Go directly and independently through the official Venmo website or mobile app. Never provide any login credentials or personal information outside of the legitimate Venmo platforms.

Double-check that any Venmo-related communication is coming from an official “@venmo.com” email address. Venmo will always and only use their venmo.com domain for emails. Be suspicious of any others. Prize scammers often mock up lookalike domains.

2. Calls Pretending to Be Venmo Representatives

Another popular scam is to receive a call from someone claiming to work for Venmo customer support. They will say they’ve noticed or been alerted to unauthorized transactions on your account. Or they may say they need you to provide additional personal information for Venmo’s records.

A very common tactic is for the caller to pretend Venmo’s two-factor authentication process is taking place. Venmo uses two-factor authentication for added account security, requiring users to enter a code sent to their phone when logging in.

The scammer will claim Venmo has texted you a verification code that they now need you to read to them over the phone. But real Venmo representatives will never call you and ask for your two-factor authentication code or other login credentials. Never provide this sensitive information over the phone.

If you have any concerns about possible unauthorized access to your Venmo account or simply want to validate a call you received, reach out directly to Venmo customer support through the official channels, either online or through the app. Venmo support will be happy to discuss your account with you. But they will never proactively call you and ask for codes, passwords, or other details. Any such unsolicited call should be treated as extremely suspicious if not an outright scam attempt.

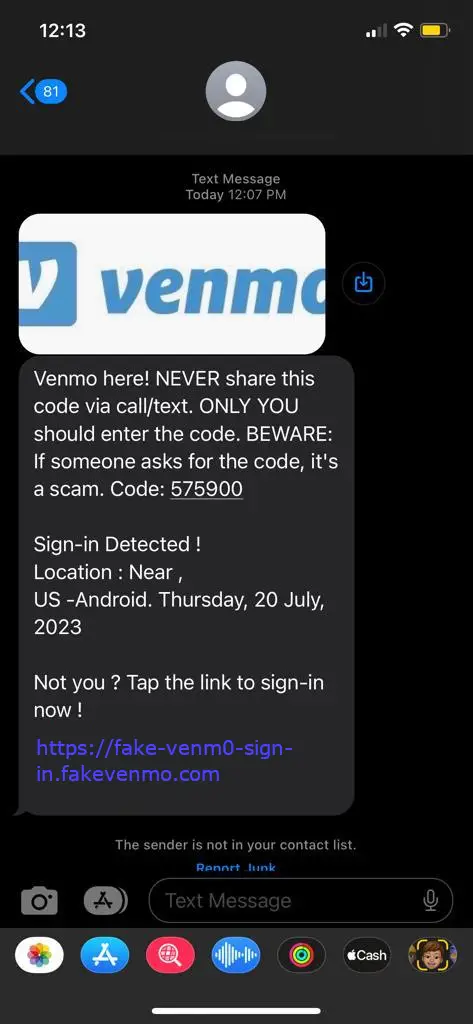

3. Fake Venmo Text Messages

Similar to calls, scammers may also send fake Venmo text messages to try and phish your information. Again these frequently impersonate Venmo’s two-factor authentication system.

The fraudulent text may even appear to come from a valid Venmo number. It will contain a link for you to click rather than an actual verification code. But real Venmo two-factor authentication texts never contain clickable links of any kind.

If you receive a suspicious text claiming to require action from you, do not click on any links or provide any information requested. Instead, contact Venmo customer support directly to verify if the text is legitimate. Venmo can look up your account and recent texts to confirm validity.

You can also look up how to properly report fraudulent texts and emails to Venmo, Facebook, and cell providers. This helps identify and shut down scammers faster. Don’t assume an odd message is valid just because it looks like it came from a trusted source. Verify before taking any requested actions.

4. Tech Support Scams

Searching online for a customer support number can sometimes lead to fraudulent numbers run by scammers instead of the actual company. The person answering will pose as a tech support agent or representative. After you explain your issue, they may then tell you payment is required upfront before assisting you. They will direct you to make this payment through Venmo to another user account they control.

But legitimate and reputable companies do not charge simply for standard customer or tech support. Major brands want customers to use their products and services. They make things easy to set up, troubleshoot, and understand. Requiring payment just for basic support is always a red flag.

If you need to contact customer support for a company, find the number directly on their official website rather than searching the open web. Navigate to their customer service or contacts page. Known brands will offer phone, email, chat, and social media support options for free.

Additionally, be very wary of anyone requesting upfront payment for services through peer-to-peer apps. That includes Venmo, CashApp, PayPal, Zelle, etc. Tell them you only pay for services after they are completed, and gauge their reaction. A scammer will typically make excuses as to why they can’t do this or threaten to limit services. Legitimate companies will have no issue with getting paid upon resolution rather than before. Don’t get pressured into paying upfront.

5. Fake Payment Confirmations

Selling items through online peer-to-peer marketplaces has become very popular. Unfortunately, these platforms also draw scammers running “fake payment” schemes.

The con artist expresses interest in purchasing your item. They may negotiate pricing and agree to terms with you. You provide your Venmo username to receive payment. Shortly after, you receive an email confirming payment to your account. Or even a screenshot showing confirmation of the funds transfer in the Venmo app.

This convinces your payment has been sent. The scammer then presses you to ship the item quickly. But the confirmation was fake. No money was transferred. The scammer disappears after receiving the item.

You should never rely on payment confirmations via email, text, or screenshots. Emails can be spoofed. Screenshots are easily doctored. Ship nothing until the payment successfully reaches your Venmo balance and clears from the buyer’s end as well.

Log directly into your Venmo account before taking any actions, no matter how convincing the communications you receive appear. Be very wary of overly eager buyers pressing you to ship items before payments are fully complete. And use common sense when assessing deals that seem too good to be true.

Also read: Top 5 Fake Venmo Payment Generators

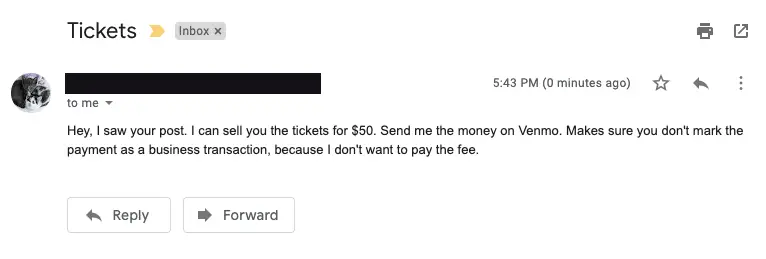

6. Prepay Scams When Buying Items

Scammers take advantage of buyers as well. When you attempt to purchase a hard-to-find or scarce item, like the latest gaming console or sold out shoes, you may deal with a fraudulent seller.

They will often persuade or pressure you to pay all or a portion of the amount upfront via Venmo before receiving the item. Claiming this is policy or required for popular items is common. After receiving your payment, excuses and delays for shipping start. But you never receive what you paid for.

Avoid paying full amounts in advance when purchasing from strangers online. At most, consider a small partial payment until you can confirm shipment and legitimacy. Be very cautious of deals that seem suspiciously discounted compared to normal prices for rare items.

Research seller names and profile photos to check for red flags. Look online for reviews and complaints before transacting. Consider using alternative services that offer buyer protections when dealing with strangers you cannot fully verify. Don’t let perceived scarcity cloud your judgment when deciding who and how to pay.

7. Friend or Family Impersonation

A common social engineering technique is for scammers to change their Venmo username and profile photo to impersonate one of their friends or family members. By studying your Venmo connections and feed, they can gather intel to make the impersonation believable.

Posing as your contact, they message requesting money for an emergency expense or urgent bill using the typical tone and language your friend would. Many people rely on Venmo within trusted social circles for quick transfers. But scammers exploit this, counting on you spotting a familiar face and name and letting your guard down.

Always independently verify any unusual money requests from friends or contacts before sending funds via Venmo or any platform. Even if the profile looks legitimate, take two minutes to call your friend or message them elsewhere. Make sure they actually did intend to seek financial help.

You can also take preventative measures with your Venmo account settings. Enable privacy options that limit your friends list visibility. Restrict your payment history from public viewing. Scammers have a much harder time impersonating contacts you closely guard on Venmo and other social platforms.

8. Random Unsolicited Payments

Out of nowhere, you may receive a small Venmo payment from a stranger you’ve never interacted with. Shortly after, they message you saying they accidentally sent the funds to the wrong person. They ask if you can please send the money back to them, often through an entirely different platform or method.

As enticing as free money may seem, this is a trick to take advantage of your better nature. The payment to you was anything but accidental. Sending funds back to this stranger would be a mistake.

If you receive a payment from someone unknown to you, do not communicate with them or return the money. Report and block that user through Venmo’s interface. Make Venmo aware by contacting support, so they can investigate potentially fraudulent account activity.

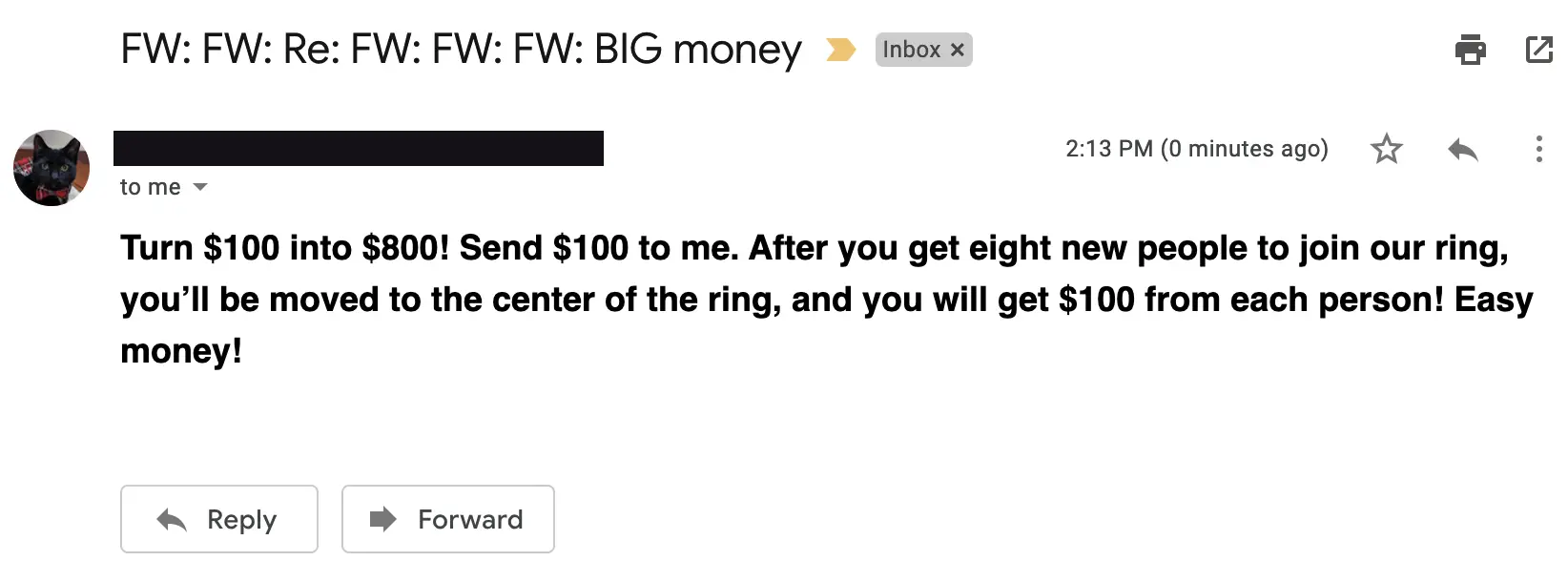

9. “Get Rich Quick” Schemes

If an investment opportunity or money-making tactic sounds too good to be true, it almost certainly is. Scammers spend lots of time crafting stories to convince you to willingly send your own money, which they pocket while promising you’ll receive even more back.

These ploys often claim to provide exceptionally high returns for a small upfront investment. The rep tells you they want to “share the wealth” or provide you a one-time chance to cash in big. Common formats are pyramid schemes, money-flipping circles, or vague online business collaborations.

Anything guaranteeing unusually large profits or returns should be treated as an immediate red flag. Do your research before sending any amount of money to an individual or company. Ask detailed questions about where your money goes and how exactly it generates returns above normal market rates.

Press for documented company information, full names of representatives, customer testimonials, and other proof of validity. And never feel rushed into completing a funds transfer on the spot. If something seems suspicious, cease communication to protect your assets.

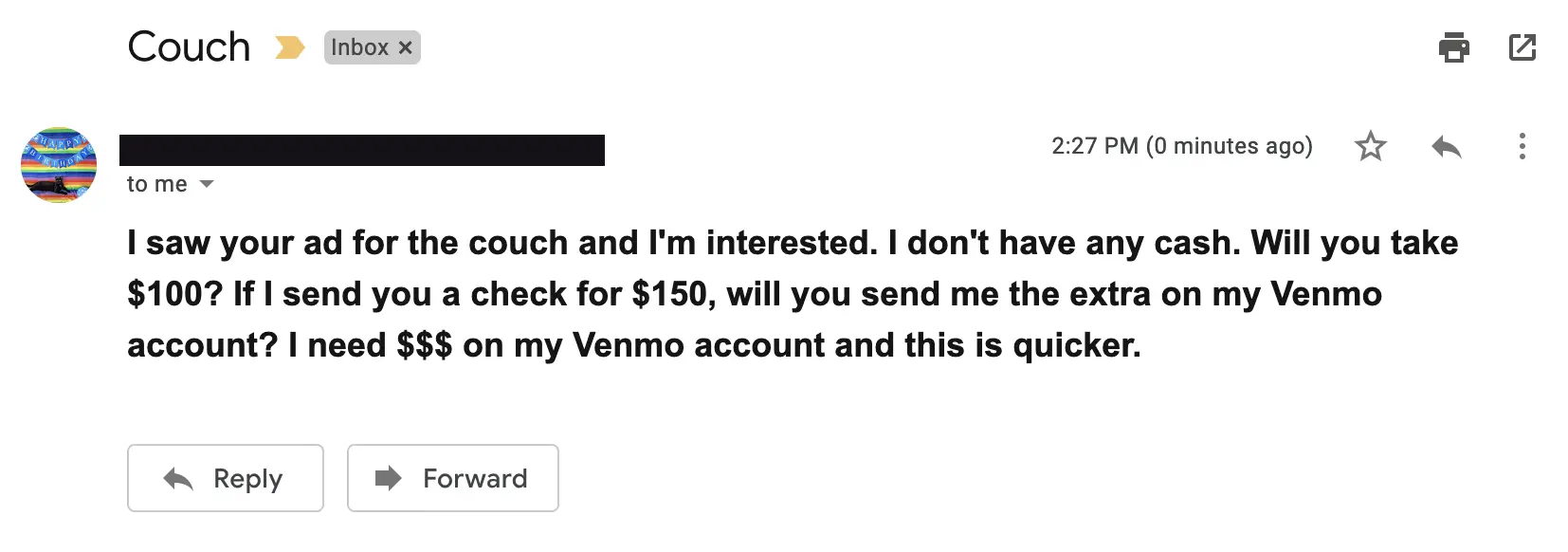

10. Paper Check Scams

A con artist may mail you a cashier’s check or other physical check. Shortly after receiving it, they contact you requesting you deposit the check and then return a portion of the amount to them via Venmo before the check formally clears.

Since checks can take days or weeks to officially bounce, even if initially accepted and showing in your account, this takes advantage of the float time between banks. The amount you send back will come out of your own money once the deposited check is rejected.

Never agree to receive checks from someone asking you to cash them, especially if they then want portions sent back electronically. This is a very common scam format. Be wary even if they overpay by accident and ask you to wire back the difference. Wait until checks fully clear before withdrawing or sending any of those funds.

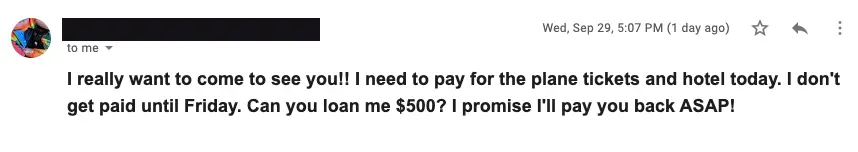

11. Romance Scams

Lonely hearts continue falling victim to romance scammers who create fake online dating profiles and identities. They spend weeks or months forming a bond and earning your trust. Then stories of financial troubles or emergencies come up, tugging at your emotions to send money to this person you feel so connected to.

But the pictures, life details, and promises are all fabricated to exploit people searching for companionship. Once they coerce you into sending money repeatedly, they disappear or eventually ask for larger and larger sums.

Never send money to someone you met and bonded with solely online, no matter how strong your feelings. Common excuses like webcam problems or overseas military service prevent meeting first via video chat. Do your investigating. Reverse image search profile pictures to check for fraud. Take extensive time, even months, to get to know new online-only friends before transactions.

And approach any emergencies and requests for financial help with extreme skepticism, especially from someone you haven’t met in person. Sad stories can easily be faked. Don’t let your emotions override logic when engaging with digital-only relationships.

How to protect yourself from getting scammed

Remaining vigilant against the variety of scams targeting Venmo users is imperative.

But you can also take proactive steps to lock down your account and payments for maximum security:

1. Review your privacy settings and ensure your friends list, transactions, and other data are not publicly visible to anyone. Scammers utilize public info to better impersonate targets.

2. Enable two-factor authentication within Venmo to require an extra login step beyond just a password. This prevents unauthorized logins even if your password gets compromised.

3. Link your Venmo to a bank account rather than just maintaining a balance within Venmo. Bank links provide additional fraud monitoring and protections Venmo alone does not.

4. Routinely check your Venmo feed and balance for any activity you don’t recognize. Report suspicious transactions or contacts to Venmo immediately to get ahead of potential scams.

5. Only use Venmo for its intended purpose – trusted transactions between known friends and contacts. Never engage with random users moving money for unclear or questionable reasons.

6. Contact Venmo customer support anytime you have concerns about account security, unusual activity, or possible scams. They can help confirm legitimacy and reverse unauthorized transactions.

Wrapping it up

Exercising smart practices and staying updated on the latest scam techniques circulating on Venmo will help you avoid falling victim to schemes aimed at misusing your account or tricking you into sending money.

Report and block sketchy users. Seek help undoing any possible unauthorized transactions. And use Venmo safely to exchange funds with your real verified friends.

Thanks for reading 🙂