Alright, check this out. We’ve seen some crazy stuff in tech, right? It keeps surprising us. First, it was all about personal computers, then the whole dot com boom. We moved on to the Internet of Things (IoT), social media blew up, smartphones are everywhere, gamification’s a thing, and AI is just… wow.

But now, let’s talk technology in finance. It’s like the next big wave in finance. Fintech’s blowing up, and it’s unstoppable. Picture this: over 26,000 fintech startups worldwide – that’s more than double from five years ago. And it’s not slowing down. We’re talking a growth rate of 20.3% annually, with the fintech market set to hit a whopping $698.5 billion by 2030. That’s huge!

So, what’s fueling the future of fintech? A big part is the e-commerce explosion, everyone glued to their smartphones, and a hungry market for cool new financial tech.

This means a ton of online transactions, heaps of data, beefed-up security needs, and massive pressure on the tech infrastructure of financial service providers.

But what is Fintech?

Let’s break down fintech technology. It’s all about using software and apps to shake up the old-school financial world. The idea is simple: make financial services more efficient, flexible, and tailored for us, the users.

There’s a whole bunch of ways they’re doing it. Think of ditching traditional payments for digital wallets, cryptocurrencies, and even quick loans.

Some companies are into crowdfunding so that people can get loans without the old bank runaround. Plus, there are robo-advising and trading apps for tailored investment advice and portfolio management. Basically, if it can be simplified, there’s an app for it.

Financial services innovation is not just changing the game for us; it’s making traditional banks rethink their whole approach.

Big banks are now teaming up with fintech firms instead of trying to build all this tech themselves. It’s smarter and cheaper, and it lets them stay in the game with all these amazing digital features.

Trends Shaping the Future of the Fintech Industry

As finance tech keeps evolving, we’re going to see some major shifts in finance and banking. It’s all about the latest and greatest in financial tech. So, keep an eye on these top fintech trends. It’s certain to be mind-boggling!

1. Open Banking: The New Cool in Finance

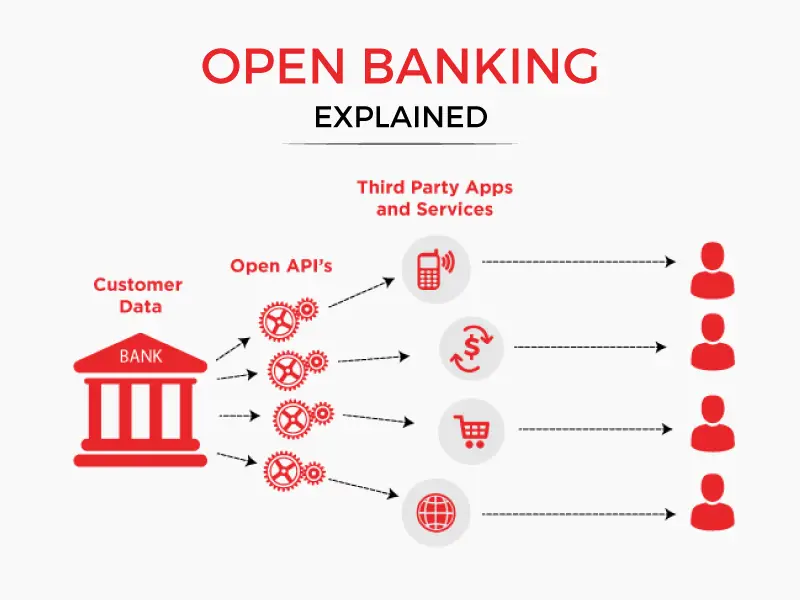

Open banking is one of the latest things in fintech software development where you get to share your financial information not just with your bank but also with other useful financial services.

They utilize APIs which let other businesses peek into your financial data to help with tasks, such as budgeting, loans, and more, all on one platform. It’s like having a financial assistant who knows you very well!

The big idea here is to make your life easier and give you more control over your money. Other than that, it helps banks keep up by being more flexible and clear about what they offer.

Right now, most APIs are used within the banks themselves, but soon, they’re planning to share them more with outside partners. This mix of traditional banking and fresh fintech vibes means you get the best of both worlds: trusty bank reliability along with some innovative digital perks.

2. Payment Diversification: More Ways to Spend Your Cash

Remember when it was just cash, credit, or debit? Well, things have changed big time. Thanks to tech and different kinds of money popping up, there’s a whole bunch of new ways to pay now. This is huge because the more ways you can pay, the more you might want to buy.

Fintech software development companies have come up with apps that take all kinds of payments – your usual cards, the latest forms of money like cryptocurrencies, digital wallets, and even peer-to-peer transfers.

There’s also a new trend called ‘Buy Now, Pay Later’ that is more popular with the younger crowd because it lets them grab what they want now and pay in installments without the hassle of credit checks and interest.

Some surveys say 67% of people think BNPL could totally take over credit cards. If this keeps up, who knows what’ll be next in the payment world?

3. Hyper-Personalized Tools: Tech That Gets You

Businesses are getting super smart about understanding us through our data. Thanks to AI and machine learning, companies are tailoring their services to fit us like a glove.

What we all want is finance management that is easy, engaging, and useful. AI and machine learning help make that happen in a bunch of ways. Like, personalized banking that gives you advice based on your spending, or smart trading for investing without human mistakes.

Even chatbots are getting better at solving our problems more humanly. And let’s not forget fraud protection – machine learning is a pro at spotting weird transactions.

So, while we’re using all these apps, machine learning and AI are quietly working in the background, making things smarter and safer for us. A staggering 70% of financial firms are already using this tech to predict cash flow and detect fraud. For us, it means smarter, safer, and more convenient ways to handle our money. And the fintech industry is eating it up.

The Bottom Line

Fintech is one of the fastest-growing industries as far as software development goes. As technology improves, more people want to reap the benefits and leverage it to make their mundane tasks easier and automated. Fintech solves just that!

Financial technology services are on the rise, and the best time to act is now.